On January 10, 2024, the U.S. Securities and Exchange Commission (SEC) approved Bitcoin Exchange-Traded Funds (ETFs) for several major firms, marking a significant milestone in the integration of cryptocurrency into mainstream finance. The approval process did not go without a few surprises, including the SEC X (Twitter) account being compromised a day earlier with a premature post announcing the approval. The post was quickly removed, but only after nearly $100 million in BTC long and short trades were executed for a loss. Additionally, SEC Commissioner Hester Pierce had a supportive post on BTC ETFs and digital assets.

The Approved ETFs

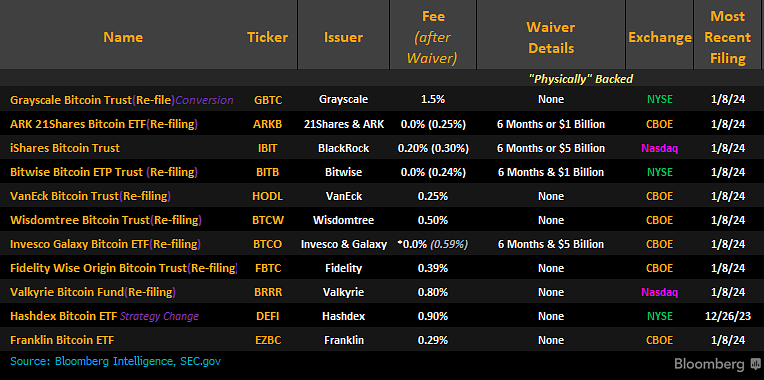

The following firms received approval for their Bitcoin ETFs:

- ARK 21Shares

- Invesco Galaxy

- VanEck

- WisdomTree

- Fidelity

- Valkyrie

- BlackRock

- Grayscale

- Bitwise

- Hashdex

- Franklin Templeton

These approvals represent a broad financial industry spectrum, from long-established institutions like BlackRock and Fidelity to newer, crypto-focused firms like Grayscale and Bitwise. All are fighting for customers and capital inflow through competitive fees.

Implications for the Market

The approval of these Bitcoin ETFs by the SEC is expected to provide a significant boost to the cryptocurrency market. It allows a wider range of investors to gain exposure to Bitcoin without the need to purchase and store the digital asset directly. This could potentially lead to increased liquidity and stability in the Bitcoin market.

According to these noted firms, Standard Chartered estimates that $50-$100 Billion this year will flow into the ETFs. An Ex-BlackRock MD says $200 Billion in the “short-term,” and Bloomberg estimates nearly $4.0 Billion will flow into the ETFs on the first-day target.

Looking Ahead

The approval of these Bitcoin ETFs is a clear signal of the growing acceptance of cryptocurrency in the mainstream financial industry. As we move forward, it will be interesting to see how these developments shape the future of digital assets and blockchain technology.

Please note that while the approval of Bitcoin ETFs by the SEC is a significant development, investing in cryptocurrencies still carries risk. Investors should carefully consider their risk tolerance and investment objectives before investing in Bitcoin ETFs. Always consult with a qualified financial advisor before making investment decisions.